Thanksgiving Reflections: Markets, Politics, and Gratitude

It is Thanksgiving week, 2024, and welcome to my favorite time of year. Thanksgiving is not just another holiday—it is the holiday. It is the one where we pause, gather, and appreciate what we have, all without the stress of gift-giving or the commercial overload of the holiday season. For me, it is about family, friends, football, and—let us be honest—homemade pie.

And I do not have to give a gift to anyone.

My granddaughter, one of the two most beautiful granddaughters in the world, is flying in with her parents—my daughter and son-in-law. Turkey, stuffing (yes, I am making my world-renowned sausage stuffing, a favorite of tens around the world), and an abundance of desserts are on the agenda.

Life does not get better than this.

A Market Priced for Perfection

Now, let us shift gears. We are starting this week off with a bang in the markets. Stocks are flying higher, thanks in part to the appointment of Scott Bessent as Treasury Secretary. It was a battle royale to get there—think "Survivor" or "The Apprentice," but with more yelling and sharper elbows. The market is thrilled today, but I wonder if Bessent knows what he is signed up for.

Let me tell you about Scott Bessent. The guy just got picked as Treasury Secretary after what looked like a Wall Street version of Survivor or The Apprentice, but his track record? Well, that is where things get interesting.

Everyone knows him as one of about ninety-seven people who love to put the George Soros British pound bet on their resume. That was really Stanley Druckenmiller's show. Sure, people were involved in executing the trades, but Druckenmiller was the mastermind behind that whole operation.

Now, let us talk about Key Square Group. Bessent started it with a cool two billion dollars from George Soros himself. Sounds impressive, right? Soros pulled his money just a few years later. The fund went from managing about five billion in assets to what I am told is around five hundred and eighty million today. That is not exactly the kind of track record that makes you want to hand over your retirement account.

Performance-wise? Let us just say it has been streaky, and not in a good way. I have easily outperformed them, probably by multiples, but no one called me about the position.

Yet another government misstep.

The market is cheering him today, but I have got to wonder if he knows what he is walking into. Between presidential promises that do not add up mathematically, markets priced for perfection, and geopolitical powder kegs everywhere you look, this Treasury Secretary job might not end up being the career highlight he is hoping for.

The broader market, meanwhile, is priced for absolute perfection. We are talking thirty times earnings on a trailing basis for the S&P 500. The CAPE ratio is at nosebleed levels, historically signaling one thing: what I like to call "fall down, go boom" territory. Am I saying it is all going to crash tomorrow? No. But the data does not paint a rosy picture for the next decade. Investor allocation to equities is at record highs, whether you are looking at individuals, pensions, or endowments.

Long-term measures like the excess CAPE yield and the market cap-to-GDP ratio scream overvaluation. If your exposure is in broad indexes, you had better have some stops in place. A single hiccup—anything, big or small—could spark a significant sell-off. This market is primed for revaluation, and when it comes, it will not be gentle.

The New Administration and Lofty Promises

As the new administration takes the reins, there is a lot to unpack. Some of the cabinet picks look promising; others, not so much. There is also some hilarity in the mix. For example, the promise to cut $2 trillion in spending and halve the deficit sounds great on paper, but let us be real about what that entails.

This year's federal budget came in at about $6.5 trillion, with roughly $4.5 trillion allocated to defense, Medicare, Medicaid, Social Security, and interest on the debt. That leaves $2 trillion for everything else—highways, education, you name it. To cut $2 trillion, we would essentially have to eliminate everything else the government does.

While I am a fan of the concept, the reality is pretty stark.

Farm and sugar subsidies—gone.

National parks—out of here.

FEMA—gone.

NASA—out of here except for military applications. China and Russia get the moon.

All funding for road construction, bridge repairs, public transportation systems, and water management projects to maintain essential infrastructure is gone.

All cancer and other medical research is left to the drug companies. The elimination of Federal grants means universities can no longer do the research.

The list goes on.

It is a worthy goal in a theoretical world, but in the real world where we have allowed the government to take over huge swaths of the economy, achieving the goal too quickly could be disastrous.

Alternatively, we could start slashing Social Security, Medicare, or defense spending, or we could default on our debt. None of these are painless choices. Cutting the federal budget on that scale would also mean mass layoffs among government workers and contractors, adding hundreds of thousands to the unemployment rolls.

Unlike in 2020, when we bounced back quickly, there would not be jobs waiting for these folks. It is a recipe for serious economic pain.

On the flip side, if we keep spending like we are trying to win a contest, we risk reigniting inflationary pressures. That would send bond prices tumbling and ripple through the stock market.

You can almost hear Linda Ronstadt and Mick Jagger singing a new duet, "Tumbling Bonds."

So, yes, it is complicated.

Whoever sold you the dream of immediate economic perfection lied.

It is a high-wire act with no net.

And, as I always say, if you think this kind of environment is a one-way ticket to prosperity, you are probably humming Linda Ronstadt and Mick Jagger's latest duet, "Tumbling Bonds," because this market setup could tumble hard under the right—or wrong—conditions.

The COP29 Climate Conference: Drama, Deals, and Hot Air

Let us turn our focus to global events, specifically COP29 in Azerbaijan, which recently wrapped up. Billed as a pivotal climate summit, the conference was more of a spectacle than a solution.

The headline deal? Developed nations committed to increasing climate financing for emerging markets, boosting the annual goal from $100 billion to $300 billion by 2035. They also pledged to find $1.3 trillion annually from public and private sources. On paper, that is impressive. In practice? It is a promise without enforcement, a handshake in a windstorm.

As usual, China played its part perfectly. Representatives nodded sagely and said they would "think about it" when asked to contribute as a major player. And, as always, the world rejoiced at this non-commitment.

The conference itself was a hotbed of chaos. There were walkouts, shouting matches, and backroom negotiations that stretched into the early hours. Saudi Arabia demanded the removal of anti-oil language, and, of course, it was promptly removed. The deal was hailed as a breakthrough, but let us be honest—it is more theater than substance.

COP has gone from being the most serious event on the UN calendar to a glorified junket. Next year's conference in Brazil will likely follow the same script, especially with a new administration in the United States that is likely to deprioritize these kinds of commitments.

Meanwhile, oil and gas continue to dominate the energy narrative. With the electrification of everything and the rise of AI, natural gas is more critical than ever. For investors, this means keeping an eye on royalty trusts and energy-focused funds. But do not jump in yet—wait for discounts and higher yields. Patience is key in this volatile sector.

Valuation, Margin of Safety, and Volatility

Through all this chaos, remember the basics: valuation, margin of safety, and making volatility your best friend. These principles are the bedrock of surviving and thriving in markets that are increasingly driven by AI and marked by political and economic uncertainty.

Gratitude for Capitalism

Now, let us talk about Thanksgiving and gratitude. I am thankful for capitalism. It is not perfect, but it is our best system. It is the system that allowed me—a high school dropout selling door-to-door—to build the life I have today. It has given us life-saving pharmaceuticals, abundant food, and technological marvels. Sure, luck plays a role, but hard work and providing value are the true keys to success.

Gratitude for the Amazing Melting Pot

Look, when we talk about diversity in America, we are looking at something that has never been done before in human history. And I mean never. Rome came close, sure, but there is a big difference between bringing conquered people and having them come voluntarily.

Every race, every religion, every cultural background you can think of exists within our borders.

We are talking about people from literally every corner of the world, bringing their traditions, their food, their music, their beliefs, all mixing together in this grand experiment we call America.

Now, I am not wearing rose-colored glasses here. We have got some dark, ugly chapters in our history book. Slavery? That is a stain that we are still dealing with the consequences of today. We fought a war to end it—bloodiest conflict in our history—and yes, we ended it. But let us be real: the path forward has not been smooth. It has been more like driving down a dirt road full of potholes in an old pickup truck. Bumpy as hell, but we keep moving forward.

But here is what makes this whole thing remarkable—it is getting better. Sure, we have had our fits and starts, our two steps forward and one step back, sometimes even three steps back. But when you look at the long arc of our history, we are making progress. It is not perfect, it is not always pretty, and Lord knows it is not as fast as many would like, but it is happening.

Think about what we have created here: a place where you can walk down any street in any major city and hear five different languages being spoken, smell food from ten different countries coming from restaurants on the same block, and see people from every background imaginable working together, building businesses, creating art, making music, and raising families.

What makes this experiment even more fascinating is how it has shaped our culture. Our music? It is a fusion of sounds from every corner of the globe. Our literature? It tells stories from every possible perspective. Our food? Do not even get me started—we have got fusion restaurants creating combinations that would make our grandparents' heads spin.

Here is the real point—this diversity is not just some feel-good story we tell ourselves. It is our competitive advantage. When you get different perspectives, different ways of thinking, different approaches to problem-solving all working together, you create something powerful. You get innovation. You get creativity. You get solutions that nobody working in their own little bubble could ever come up with.

But let me be crystal clear about something: pointing out our progress does not mean ignoring our problems. We have still got work to do. Lots of it. We are still dealing with systemic issues, still working through prejudices, still figuring out how to make this whole experiment work better for everyone. And that is acceptable—because acknowledging where we need to improve does not diminish how far we have come.

The magic of this whole thing is that it is ongoing. We are not done. This experiment is not over. Every day, new Americans are arriving, bringing their dreams, their traditions, their perspectives. Every day, we are learning how to be better at this whole diversity thing. Sometimes we stumble, sometimes we fall, but we keep getting back up and trying again.

That is what makes America different from every other experiment in diversity in human history. It is not perfect, it is not finished, but it is real. It is messy and complicated and sometimes frustrating as hell, but it is also beautiful and inspiring and absolutely unique in human history.

When you really think about it, what we are doing here is pretty damn remarkable. We are taking people from every culture, every background, every belief system imaginable, and we are trying to build something together. Has it always worked perfectly? No. But we are still at it, still trying, still moving forward. And that, my friends, is something worth being thankful for.

Remember this—diversity is not just about checking boxes or meeting quotas. It is about creating something entirely new, something that has never existed before in human history. It is about taking the best of everything that makes us different and using it to build something better together. That is the American experiment, and despite all its flaws and challenges, it is still the most ambitious and successful attempt at multicultural democracy the world has ever seen.

My Lifelong Affair With Books

I am thankful for books.

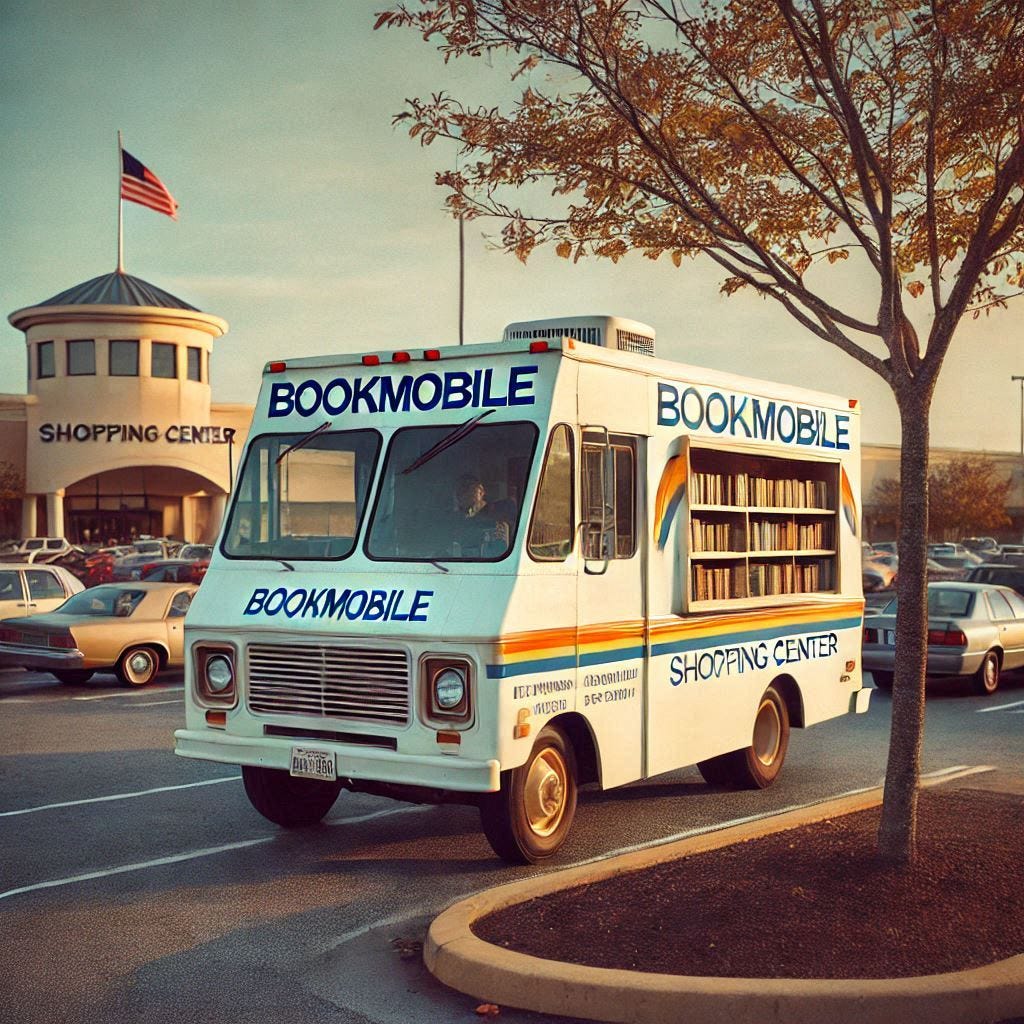

If there is one thing that made me who I am, it is the written word. Growing up, we did not have much, but we always had access to books. My mother took us to the bookmobile every Thursday night. On those magical nights, we could grab anything we wanted—on the condition that we could read and understand it.

I was that kid reading well beyond my years. Sometimes it was books I should not have been reading at my age. But those books sparked my curiosity, expanded my imagination, and taught me how the world worked.

Books remain my constant companions. Whether it is finance, politics, or a novel, you will find me with a book in hand—even during a baseball game or a conversation with my wife (to her eternal dismay). They have inspired dreams and equipped me to pursue them.

One of these days, I will share a proper reading list. I did one earlier this year, and the feedback was fantastic. We will do it again because the lessons and joy books provide are invaluable.

I ma a grateful for family. It is sometimes messy and frequently loud, but it is always family first, last, and always.

Watching the kids grow to amazing adults has been the ultimate thrill ride.

The fact that I have been lucky enough to become a grandparent of two amazing little girls is a source of constant amazement and happiness.

Grateful for The Day My Life Changed

Speaking of luck, let me tell you about the day my life took a turn for the better. Fourteen years ago, a friend called and said, "Hey, my sister is in town, and we have been out to brunch. We do not realy feel like driving. How about a ride to the wine bar?"

It was a lazy May afternoon, the Orioles were losing, and I figured, why not?

We met, and that sister turned out to be someone extraordinary. Six months later, we were married. Over these 14 years, she has anchored me in ways I never could have imagined. She has made me a better man, father, and husband, holding me to the standards I aspire to and helping me exceed them.

She is the center of my world, and I am endlessly grateful for her.

She is the rock and cornerstone of our family., she will work her magic in the kitchen come Thanksgiving

As a not insignificant bonus, come Thanksgiving, she will work her magic in the kitchen, and it will be nothing short of spectacular.

Final Thoughts

As we head into Thanksgiving, let us remember what really matters. Family, gratitude, and the privilege of living in a country that, for all its flaws, offers unparalleled opportunities.

Thank you for being part of this journey. I hope you and yours have a fantastic Thanksgiving. Let us keep making it fun, exciting, and, most importantly, wildly profitable.

Happy Thanksgiving, everyone!

Share this post